What is Trial Balance

A trial balance is an accounting report used to verify the accuracy of various debit and credit transactions reported in the ledgers. In the trial balance, the total debit and credit balances are equal.

The trial balance can be prepared at the end of the month or at the end of the accounting period, depending on the entity’s requirements.

What is a Balance Sheet

A balance sheet is a financial statement that displays the company’s liabilities, assets, and shareholder equity. It is prepared only at the end of the accounting period.

The total assets of a company are equal to the number of liabilities and stockholders’ equity on a balance sheet, which is based on an equation.

In this article, we are going to talk about the differences between trial balance and balance sheet.

The easy-to-use accounting software from IntelliBooks will connect your bank accounts, synchronize your costs, balance your books, and get you ready for tax time

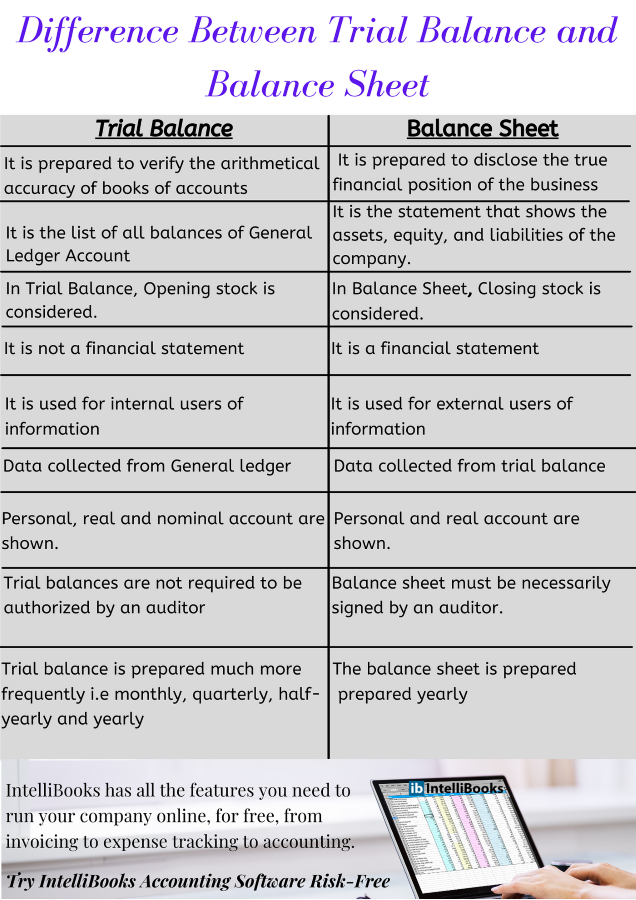

Difference Between Trial Balance and Balance Sheet

- A trial balance is prepared to verify the arithmetical accuracy of books of accounts whereas a Balance sheet is prepared to disclose the true financial position of the business.

- Trial Balance is the list of all balances of the General Ledger Account whereas the Balance sheet is the statement that shows the assets, equity, and liabilities of the company.

- In Trial Balance, Opening stock is considered whereas Balance sheet Closing stock is considered.

- A Trial Balance is not a financial statement whereas a Balance sheet is a financial statement.

- A Trial Balance is used for internal users of information whereas a Balance sheet is used for external users of information.

- In Trial, Balance data is collected from the General ledger whereas in the Balance sheet data is collected from the trial balance.

- Trial Balance Personal, real and nominal accounts are shown whereas in the Balance sheet Personal and real accounts are shown.

- Trial balances are not required to be authorized by an auditor whereas a Balance sheet must be necessarily signed by an auditor.

- The trial balance is prepared much more frequently i.e monthly, quarterly, half-yearly, and yearly whereas a Balance sheet is prepared yearly.

- A trial balance is made for detecting mathematical errors and checking the accuracy of transactions whereas a Balance sheet is made for the purpose of ascertaining the financial position of an entity during the end of a particular financial year.

IntelliBooks has all the features you need to run your company online, for free, from invoicing to expense tracking to accounting.